Obsidian Market Update 3/17/2023

Never a Dull Moment in the Markets

The recent failure of three banks has been in the news and rightfully so has caused concern. This has had an affect both on corporations and individual depositors all over the country. The banking sector has reacted very poorly in the markets. We wanted to address the bigger picture. Out of fear, many folks and businesses still, were moving funds from regional banks to “too-big-to fail” megabanks.

What is going on?

Obviously, the situation is fluid, but before sharing our takeaways, let’s summarize a few of the factors in play.

Three Banks Fail

A number of factors contributed to the voluntary liquidation of Silvergate Bank and closure of Silicon Valley Bank and Signature Bank of New York. Among them:

- Large cryptocurrency deposits. SBNY held $16.52 billion, SVB held $3.3 billion, and Silvergate (as of 9/30/22) $11.9 billion in digital asset-related deposits. After the bankruptcy of Sam Bankman-Fried’s FTX exchange in November of 2022, customers at these banks began to withdraw their deposits.

- Focus on niche customers. The bulk of Silvergate’s and SVB’s customers were tech start-ups; SBNY’s were real estate and law firms, and taxicab medallions.

- Rising interest rates. Sharp increases in Federal Reserve interest rates reduced the value of these banks’ bonds portfolios.

The Market Responds

On Monday, March 13, the New York Stock Exchange halted trading to prevent crashes for several banks, including Western Alliance, First Republic Bank, Zions Bancorp, Comerica, East West Bancorp and Regions Financial.

The Government Responds

The U.S. Government—Federal Deposit Insurance Corporation (FDIC), Federal Reserve and Treasury Department—has stepped in quickly to protect depositors, remove the managers whose decisions led to the meltdown at these banks, and help other banks by providing additional funding.

What are we learning?

Diversification is good—for everyone.

We are committed to diversification in our clients’ portfolios. Banks whose portfolios were overly concentrated in one market sector or in high-risk investments proved to be especially vulnerable.

Competition is good for depositors.

With pressure to retain deposits, banks will have to compete to retain depositors. This means better rates of return for savers.

The Fed may—or may not—slow its roll.

On March 7, Federal Reserve Chairman Jerome Powell told the Senate Banking Committee that “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.” Not long after, we learned that in February:

- The U.S. added 311,000 jobs

- The unemployment rate inched up from 3.4% to 3.6%

- Average hourly earnings rose by 4.6% over the past 12 months

- Inflation (as measured by the Consumer Price Index) increased by 0.4% (after an increase of 0.5% in January) but decreased to 6% (from 6.4% in January) on an annual basis. That’s the smallest 12-month increase since the period ending September 2021.

With the employment market remaining strong and inflation slowing only marginally, one might expect Chairman Powell to move aggressively at the Fed’s next meeting on March 22—if not for the bank situation. We will have to wait and see what happens.

As always, we’ll be paying close attention to this rapidly evolving situation. If you have any questions or concerns, please don’t hesitate to contact us.

How We Can Help

Forget Your Password?

These three little words usually prompt us to answer one or two security questions or open a confirmation message sent to our email address. Voila! Access restored. Unless…

We recently met with a new widow who had been denied access to most of her deceased husband’s accounts because she didn’t know his passwords—including the one to his email account. We helped her contact many financial institutions to gain access, but the process was hugely time consuming.

Had our client’s husband used a password manager (e.g., LastPass, 1Password, Bitwarden), she could have accessed all his accounts with just one password.

Once you create a single password, a password manager creates unique passwords for every account, automatically fills in usernames and passwords, uses encryption to help guard your information from data breaches, and provides access from computers, tablets, and phones.

We use password managers (personally and as a company) and highly recommend them.

Lifestyle

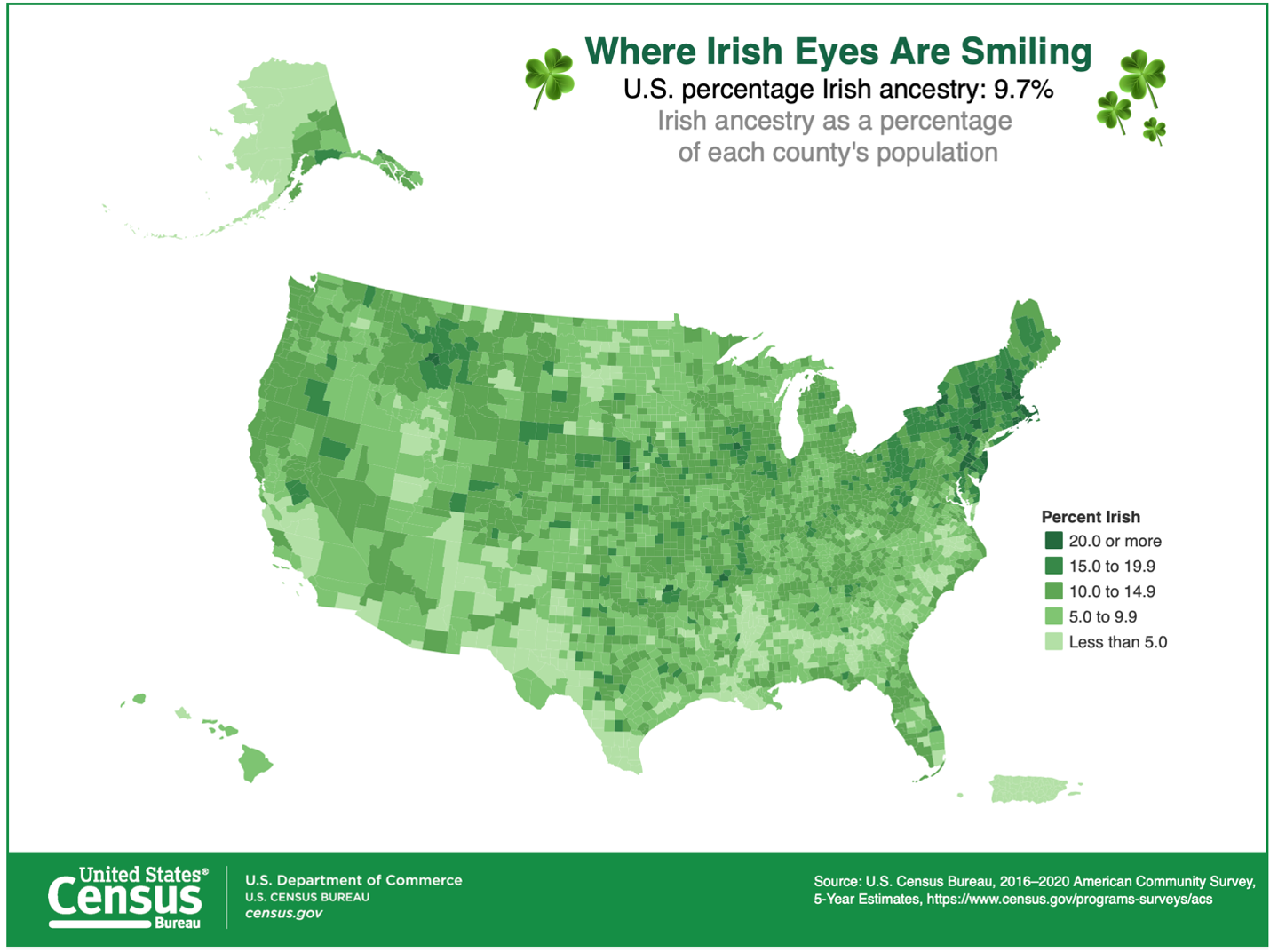

A Quiz for the Red, White, Blue and Green

- How many U.S. residents claim Irish ancestry?

- How many pounds of vegetable dye does it take to turn the Chicago River green?

- What U.S. city hosts the largest St. Patrick’s Day parade?

- How many U.S. Presidents claim Irish heritage?

- How many Irish pubs are there in the U.S.?

(answers below)

Source: https://www.census.gov/library/visualizations/interactive/irish-eyes.html

Quiz Answers:

- According to the U.S. Census bureau, 31.5 million residents (9.7%)

- 50

- New York City

- 23

- 4000

Advisory Services offered through Obsidian Personal Planning Solutions, LLC. Securities are offered through Triad Advisors, member FINRA/SIPC. Obsidian Personal Planning Solutions, LLC, and Obsidian Personal Planning Solutions, Inc, are not affiliated with Triad Advisors.